kwsp contribution rate 2019

The employer contribution is taxed at the employees marginal tax rate so the actual amount the employee receives in their account is between 183 and 2685. EPF also known as KWSP is calculated in different way due to the salary of employee.

Your mandatory contribution is calculated based on your monthly salary as an employee in accordance with the Contribution Rate Third Schedule.

. MCMC MTSFB TC G0092019. KWSP Wells and Pumps. Access to internet banking makes EPF contribution payments much easier now.

Kadar caruman kwsp pekerja diturunkan daripada 11 kepada 7 berkuatkuasa 1 april 2020. Dividend rates for Simpanan Shariah will be based on actual performance of the EPFs shariah compliant investments. The table for 2021 employee and employer EPF contribution rate.

Related

Effective from 1 January 2019 to March 2020 January 2019 salarywage up to March 2020. Kadar caruman kwsp adalah berbeza mengikut kerakyatan malaysia atau individu pemastautin dan juga usia. The contribution rate for employees and employers can be referred in the Third Schedule EPF Act 1991 as a guide.

In early 2019 I registered myself for EPF i-Saraan previously known as 1Malaysia Retirement Savings Scheme or SP1M. For the salaried employee with the EPF contribution rate of between 7 to 11 employee and 12 or 13 employer most likely your EPF savings are not sufficient. 5 Experience and Contribution of Professional Associations june 18 2019.

Web Kadar caruman di bawah jenis ini adalah daripada syer majikan sahaja iaitu sebanyak 125 daripada gaji bulanan pekerja itu mengikut jadual caruman yang telah ditetapkan. KUALA LUMPUR 7 January 2019. MCMC MTSFB TC G0102017.

Otherwise just continue hoping for the 5 to 6 dividend yield. EPF Dividend Rate. Radiocommunication Network facilities - Smart Pole.

As for EPF Self Contribution or KWSP Caruman Sendiri. Untuk maklumat lanjut ahli dan majikan boleh merujuk laman web KWSP di newepfgovmy atau hubungi Pusat Pengurusan Perhubungan KWSP di 03-8922 6000 atau kunjungi mana-mana cawangan KWSP terdekat. Jadual caruman kwsp yang terbaru dan terkini contribution table rate 2022 untuk semua.

For employees who receive wagessalary of RM5000 and below the portion of employees contribution is 11 of their monthly salary while the employer contributes 13. 15 November 2017. He previously served as a member of the National Debt Liability Management Committee from 2019 to 2020.

Monthly contributions are made up of the employees and employers share which is paid by the employer through various methods available to them. If you are interested to know the calculation of the EPF contribution formula you have came to the right place. Ref Contribution Rate Section D.

MCMC MTSFB TC G0112017. For employees who receive wagessalary of RM5000 and below the portion of employees. Employers must remit the employees contribution share based on this schedule.

Access to internet banking makes EPF contribution payments much easier now. Employers need to submit VE Employees Share and VE. The new minimum statutory rates will start.

Again helping b40. Corporate tax individual income tax and sales tax including VAT and GST and capital gains tax but does not. 20190121 MoFEC DSA rate.

Last year was an all time low in the cycle looking at Fed Reserve as proxy to BNM rates. I forsee that perhaps in several years time potentially FD could EPF dividend yield again. 11032019 147 Kadar Berkanun Untuk Caruman Syer Pekerja Kembali Ke 11 Mulai UpahGaji Januari 2018.

If u still have money in KWSP then unarguably its your money and you have the right for it. The list focuses on the main types of taxes. Digital Terrestrial Television DTT - Content Contribution.

In the event you are looking for ERP system with an affordable HR Payroll read this HR Payroll for Malaysia. Subject to the provisions of section 52 every employee and every employer of a person who is an employee within the meaning of this Act shall be liable to pay monthly contributions on the amount of wages at the rate respectively set out in the Third Schedule. Learn more about EPF calculator Malaysia for HRMS.

The contribution rate for employees and employers can be referred in the Third Schedule EPF Act 1991 as a guide. Interest rate cycle is between 8 to 14 years. From January 2019 all the foreign employees are liable to contribute SOCSO.

Employers must remit the employees contribution share based on this schedule. KWSP bukan bank want to pinjam2. To cancel the option to contribute in excess of the statutory rate members must complete Form KWSP 17A AHL18A AHL and submit to the employer.

For all your contributions the government guarantees a minimum paid dividend rate of 250 for Simpanan Konvensional. To cancel the option to contribute in excess of the statutory rate members must complete Form KWSP 17A AHL18A AHL and submit to the employer. Subject to the provisions of section 52 every employee and every employer of a person who is an employee within the meaning of this Act shall be liable to pay monthly contributions on the amount of wages at the rate respectively set out in the Third Schedule.

Standard Employer EPF Rate is 13 if the Salary is less than RM5000 while 12 if the Salary is more than RM5000. Employers need to submit VE Employees Share and VE. The current contribution rate is in accordance with wagesalary received.

Ref Contribution Rate Section D. From January 2016 there is an income tax relief of MYR 25000 per annum for SOCSO contribution. Employers must remit the employees contribution share based on this schedule.

Can go figure it out at that time again. But if no money inside then u dont have the right to make noise to borrow. Then M40 and T20 have to top up their kwsp contribution so KWSP can invest more in other things.

KWSP - EPF contribution rates. A comparison of tax rates by countries is difficult and somewhat subjective as tax laws in most countries are extremely complex and the tax burden falls differently on different groups in each country and sub-national unit. Jadual caruman kwsp yang terbaru dan terkini contribution table rate 2022 untuk semua pencarum di malaysia epfgovmy.

Web Kwsp jadual caruman 2020 pdf kwsp kiraan kwsp mestilah mengikut. For employees who receive wagessalary exceeding RM5000 the employees contribution of 11 remains while the employers contribution is 12. The Employees Provident Fund EPF announces that the minimum Employers share of EPF statutory contribution rate for employees above age 60 who are liable to contribute will be reduced to four 4 per cent per month while the Employees share of contribution rate will be zero per cent.

你好我2019年一月尾停職後轉做freelancer 收入不固定大多數的酬勞都沒有invoice 平均月入不超過兩千請問我還需要報稅嗎朋友說填B form那前公司發給我的一月份薪資也納入B form的總收入嗎B form裡面的公司資料等我都沒公司該怎樣填. He is a member of the Malaysian Institute of Accountants MIA and the Malaysian Institute of Certified Public Accountants MICPA. Employers must remit the employees contribution share based on this schedule.

4 October 2019. From the start of the scheme until May 2015 those who joined KiwiSaver received a 1000 tax-free kick start to their KiwiSaver account from the government. Radiocommunications Network Facilities - In Building.

Stage 1 Below 60 years old. Since 2020 the default. He also held the position of Independent Non -Executive Director at Bank Negara Malaysia from 2018 to 2019.

Effective from 1 January 2019 to March 2020 January 2019 salarywage up to March 2020.

View Contact Number Kwsp Shah Alam Pictures Kwspblogs

Epf A C Interest Calculation Components Example

Epf Interest Rate From 1952 And Epfo

Epf Declares Dividend Of 6 10 For 2021 Above Pre Pandemic 2019 The Edge Markets

Time Value Of Money Computing The Retirement Fund In Epf Account Of An Employee Kclau Com

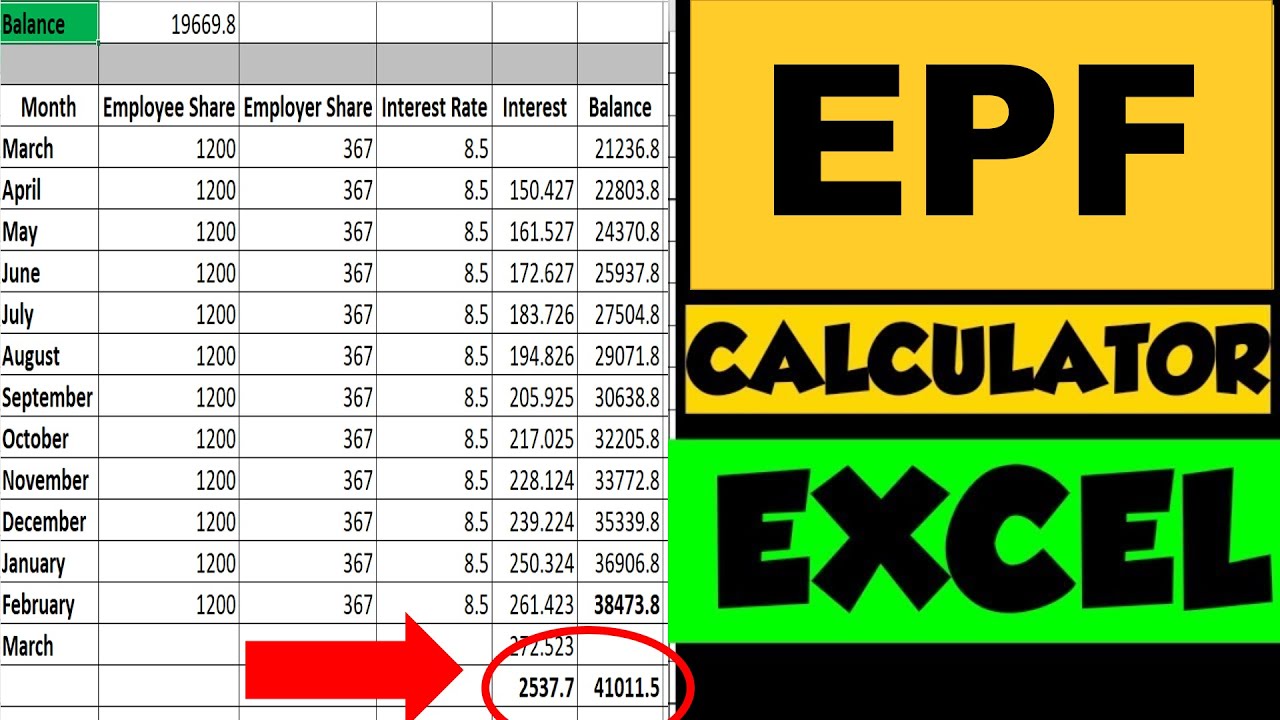

Epf Excel Calculator Employee Provident Fund How To Calculate Epf Interest With Epf Interest Rate Youtube

Epf Historical Returns Performance Mypf My

Esi Contribution Rate Reduced Wef 01 07 2019 Simple Tax India

Retirement Epf Interest Rate Slashed To 8 1 For 2021 22 Can You Still Save Enough For Your Retirement The Economic Times

20 Kwsp 7 Contribution Rate Png Kwspblogs

3 Key Things You Need To Know About Employees Provident Fund Epf

Epf Interest Rate 2019 2020 Historical Interest Rates From 1952 To 2019 Basunivesh

Kwsp All About Your Responsibility

Employer Contribution Of Epf Socso And Eis In Malaysia Foundingbird

Why Epf Returns Are Lower The Star

Epf Contribution Rate Table Urijahct

0 Response to "kwsp contribution rate 2019"

Post a Comment